The impact of Covid-19 on South Africa's economy and investment landscape

THE GOVERNMENT’S RESPONSE TO THE PANDEMIC

In August 2020, South Africa had the fifth highest number of confirmed cases globally, with latest statistics claiming over 587,000 confirmed cases and over 11,830 deaths. This translates into approximately 10,300 people infected per million of the population, and 207 deaths per million. It also equates to an infection rate surpassing 500 new cases per hour, a rate that the country’s public and private health care systems cannot realistically match. This is despite the implementation of one of the world’s strictest COVID-19 response measures; specifically, a countrywide lockdown which saw most economic activity halted between 27 March and 31 May, excluding essential services and activity which could continue under full remote-working conditions. But in an economy structured along mining, manufacturing and tourism and the like, not much commercial activity continued.

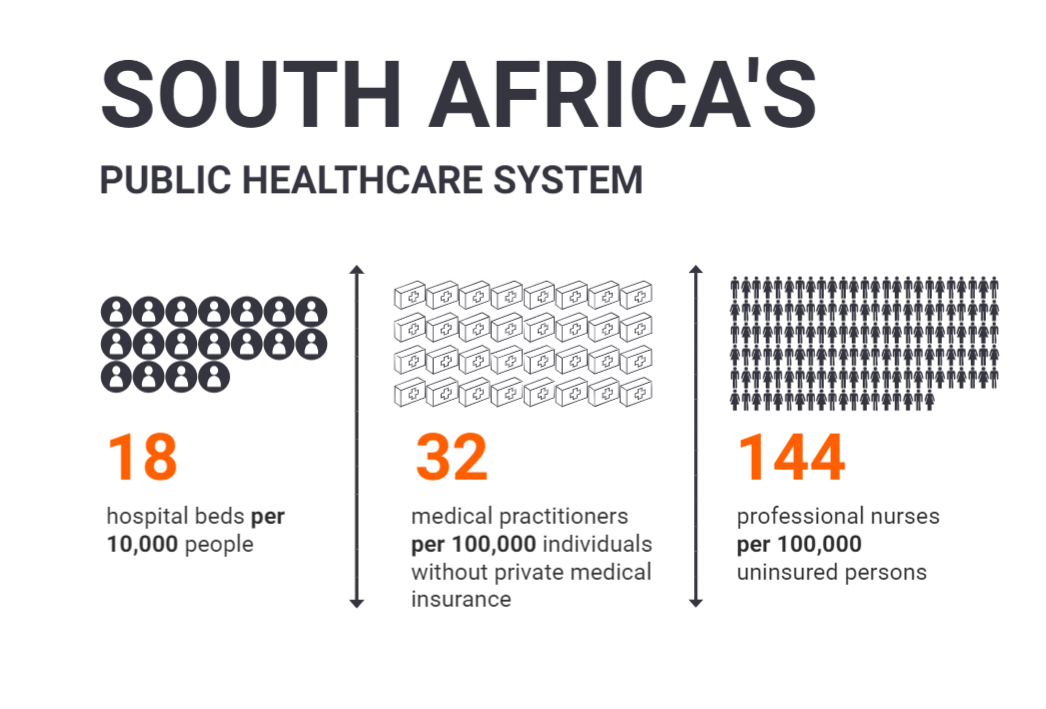

This severe response was largely due to the status of South Africa’s public healthcare system. According to 2018 figures, there are about 18 hospital beds per every 10,000 people in the country. In the public health sector, there are 32 medical practitioners per 100,000 people who do not have private medical coverage, and about 144 professional nurses per 100,000 uninsured persons. According to World Bank data for the UK by comparison, those figures are 280 and 820 per 100,000 people respectively.

Having to balance the decision between a humanitarian crisis or an economic one, from 1 June, the ruling African National Congress (ANC) introduced a five-level risk-adjusted strategy, where restrictions change according to threat level. Level 5 comprises a national lockdown while Level 1 allows most commercial and social activity to resume with additional health and safety protocols in place. South Africa was under Level 3 for several weeks, but restrictions within this level were adjusted many times, a likely indication that the government was hesitant to raise the level once more due to the impact on the economy. Now, in recognition of the need to restart the economy, on 15 August President Ramaphosa announced that the country’s Alert Level would be lowered to Level 2, effective 18 August, though opposition members have claimed this could be too little too late to counter the economic impact of COVID-19.

THE IMPACT ON THE ECONOMY

The decision to implement strict social distancing measures and limiting non-essential business, has had a large impact on South Africa’s economy. The lockdown forced a reduction in production and a slowdown in non-essential business; it impacted household spending patterns, while the disruption to global production and supply chains and the effect of uncertainty on the commercial environment and financial markets have also aggravated the combined negative impact on the economy.

The lockdown, coupled with a ZAR 500 billion (USD 26 billion) stimulus package to prepare the healthcare sector and protect jobs will result in a need for higher public spending, and exacerbate existing economic challenges, including government debt. Latest estimates concerning economic growth in South Africa vary, but they all paint a rather grim picture. According to credit rating agency, Standard & Poor’s, the economy will contract 4.5 percent this year. Meanwhile the South African Reserve Bank places the figure at 7 percent, and Moody’s at 6.5 percent. Finance Minister Tito Mboweni stated during his reviewed budget speech in June that tax revenue is expected to fall by R300 billion. To cover the stimulus package and other government deficits, South Africa has had to tap into the international debt market, including approaching the International Monetary Fund, the World Bank, African Development Bank and the BRICS partnership.

The impact has been felt across sectors, particularly retail and hospitality, but heavy industries like construction, mining and manufacturing have also recorded productivity losses.

The impact has been felt across sectors, particularly retail and hospitality, but heavy industries like construction, mining and manufacturing have also recorded productivity losses. Widespread redundancies have already been reported across sectors, with current estimates of total job losses due to the pandemic sitting at between 700,000 and 1.8 million, according to the National Treasury. Other estimates places this figure closer to 3 million jobs lost. According to the latest numbers published by Statistics South Africa, there are 16.37 million people employed in the formal and informal sectors. Taking the projected job losses into account, this will equate to job losses for between 4 and 10 percent of the workforce.

RISING UNEMPLOYMENT

South Africa already faces a dire unemployment crisis. According to national statistics unemployed persons increased by 344,000 to 7.1 million in the first quarter of 2020. In turn, the official unemployment rate has increased to 30.1 percent, up from 29 percent in December 2019. The youth (aged 15 – 34) remain most impacted by joblessness, with youth unemployment at 44 percent in December and now projected to reach close to 60 percent.

In line with dominant views in development economics, South Africa’s informal economy should serve as a shock absorber amid the anticipated job losses. This argument holds that there are no barriers to entry to the informal economy, so workers will move into this part of the economy following job losses in the formal sector. However, South Africa is proving to be a unique case. The country’s informal economy has a relatively low absorption rate. About 5 million people or 34 percent of the working population are in the informal sector; this is relatively low when compared to the global average of around 60 percent of the workforce. This, amid such a high unemployment rate, means there is little guarantee that the informal economy will be a shock absorber, and instead could contribute to greater employment losses in South Africa.

RISING GOVERNMENT DEBT AND COINCIDING CRISES

While South Africa has suffered from flattened economic growth for the past five years, averaging 1.5 percent per annum, and rising unemployment is not new, in February 2020, the government had committed to combatting government debt and decreasing public spending. Yet, this road is no longer feasible given the government’s need to respond to COVID-19, and South Africa’s debt-to-GDP ratio is expected to increase from 61.5 percent to 85.6 percent by the end of 2021. According to a 2010 World Bank study, countries whose debt-to-GDP ratios exceeds 77 percent for extended periods experience slowed economic growth. Specifically, every percentage point above the 77 percent threshold costs countries 0.017 percentage points in economic growth. For emerging countries, every percentage point above 64 percent slows growth by up to 0.02 percentage points each year.

SECURITY CONSIDERATIONS

The socio-economic consequences of the pandemic are also likely to aggravate existing security concerns in the country, specifically civil unrest and crime. Focusing on the pandemic itself, localised protests against government community relocation programmes, aimed at de-densifying highly populated areas, have continued. For example, in Cape Town, around ZAR 8 million in public transport infrastructure was burnt during just two days of protest action in June. Allegations of corruption in the distribution of government relief funds are also likely to prompt further public protest in the coming months while the impact on unemployment will place additional pressure on government social grants.

Service-delivery protests – community protests against a lack of government services in the area – are also likely to ramp up. There were over 200 such protests recorded in 2019 and while lockdown measures have dampened 2020 protest levels, demonstrations will resume as restrictions ease. Service-delivery protests have a higher propensity for violence, as they often lack formal organisation, authorisation from local authorities, and often occur in areas with poor relations between the community and law enforcement. According to local statistics, 94 percent of service-delivery protests have historically involved violent confrontations and can include damage to local property and looting.

According to local statistics, 94 percent of service-delivery protests have historically involved violent confrontations and can include damage to local property and looting.

Crime has also continued, and despite an initial decline under the Level 5 lockdown, crime rates are normalising amid increased reports of armed robberies targeting couriers and the trucking industry, as well as continuing violent crime. The latest ban on alcohol sales is partly aimed at reducing violent incidents to alleviate the pressure of trauma cases on the overstretched healthcare system. However, the ban on tobacco and alcohol will drive up counterfeit activity once more, while reducing the government’s ability to claim ‘sin tax’ or additional value added tax on these luxury items.

THE WAY FORWARD

Yet, the South African government has not been idle and is looking at ways to navigate the country out of this crisis. The country’s economic crisis is not purely the result of the pandemic, but rather several years of government mismanagement, particularly under the ‘state capture years’ of the Jacob Zuma administration. Still, the incumbent government is eager to use this moment as an opportunity to restructure the economy; although public and business trust in the government’s ability to achieve this is mixed.

According to the June Sustainable Infrastructure Development Symposium South Africa (SIDSSA), the government is set to prioritise large infrastructure projects as the way out. Although business and government disagree on how to fund and structure this, they could present an attractive opportunity for domestic and foreign investment. To promote recovery, the president highlighted the need for projects that would lead to significant job creation and which are located in sectors that have the strongest economic multiplier effect, such as energy – to also address South Africa’s power crisis – as well as water, transportation and information & communications technology.

Yet, financial institutions remain cautious on how the government, specifically the ANC, will achieve this while also accommodating its economic transformation goals and getting debt challenges under control to attract FDI. In addition, corruption continues to plague government economic recovery efforts. To appease public concerns over corruption, particularly in government procurement, President Ramaphosa has announced the formation of a centralised unit to tackle COVID-19-related corruption in government in July. The unit comprises the Directorate for Priority Crime Investigation, National Prosecuting Authority, the South African Police Service, Special Investigating Unit (SIU) and the Independent Police Investigative Directorate. However, with contracts for the emergency purchase of personal protective equipment (PPE) worth ZAR 2.2 billion and involving over 90 companies already under investigation by the SIU over alleged corruption in Gauteng province alone, this task will be increasingly difficult.

Meanwhile, Standard & Poor’s has its eye firmly on politics and policy, claiming they would also consider another downgrade for South Africa if the rule of law, property rights, or enforcement of contracts were to weaken significantly, undermining the investment and economic outlook. Any renewed drive for land expropriation without compensation, for example, would therefore likely see South Africa’s debt downgraded further, which in turn would raise borrowing costs even more.

It still remains to be seen whether the 88 projects to be gazetted following SIDSSA are of a sufficient quality and readiness to represent a genuine set of bankable projects for the market. It is clear that South Africa has a challenging road ahead, and with the number of COVID-19 cases still rising, businesses, government and people alike will need to remain adaptable to an ever-changing post-pandemic South Africa.