The reverberations of war: The commercial impact of the Israel-Iran war

On 13 July, Israel and Iran went to war, marking the latest and most severe confrontation in a string of deadly encounters between the two long-time foes. The conflict lasted for 12 days; 935 people were killed in Iran, and 29 in Israel. Both sides sustained significant damage to strategic infrastructure, including (but not limited to) nuclear and energy facilities in Iran, and healthcare, port and oil refineries in Israel. In addition, as an important transit zone between Asia and Europe, the conflict had real repercussions for the wider Middle East region, with disruptions most clearly visible in the shipping and aviation sectors.

Maritime disruptions

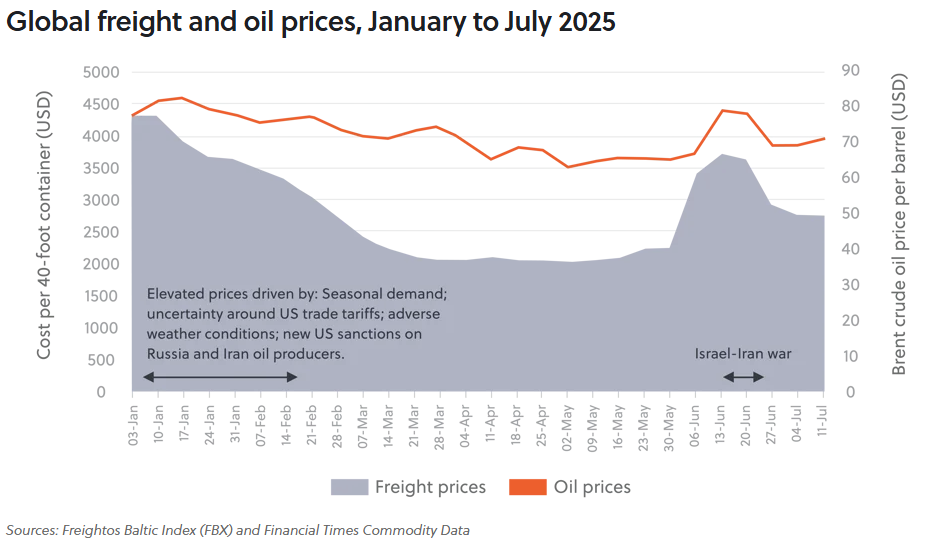

With the Iranian-controlled Strait of Hormuz accounting for between 20 and 25 percent of the world’s seaborne oil and gas, the conflict had an immediate – if short-lived – impact on global oil prices, as well as freight costs and war-risk insurance for shipping companies transiting through the strait. Although this latest surge in oil and freight prices was brief, and largely geographically contained (compared to past global shocks that had inflationary repercussions globally), it nevertheless highlighted the persistent vulnerability of the world’s commodity prices and supply chains to sudden and dramatic developments in the Middle East. Some major shipping companies diverted away from the region entirely, choosing instead to take the longer route around the Cape of Good Hope, while others avoided or scaled back operations at high-risk ports. On 20 June, for instance, Iranian airstrikes on Israel’s port at Haifa prompted several global shippers to suspend or reduce shipments – particularly of hazardous cargo.

In addition, the conflict coincided with a surge of signal jamming around the Strait of Hormuz and the wider Arabian Gulf, affecting vessels’ ability to accurately transmit their positional data. The origin of the electronic interference remains unclear – with both Israel and Iran demonstrating a willingness to deploy asymmetric disruptive measures – but it nevertheless caused significant navigational and safety challenges for ships in the region. By some estimates, an average of 970 ships were affected by signal jamming per day during the war. In one notable incident on 17 June, two oil tankers collided after a navigational error off the coast of the UAE’s Khor Fakkan port city, close to the Strait of Hormuz. A fire was extinguished on one vessel, while 24 crew members were evacuated from the other.

Aviation over the Middle East

For the global aviation industry, no commercial airports or planes were directly hit, but the reverberations of war were nevertheless widespread and immediate. Alongside Israel and Iran, airspaces closed across the region, with permanent or repeated disruptions to air traffic above Iraq, Jordan, Syria and Lebanon. Most airlines cancelled or rerouted flights away from the region; thousands of passenger planes were affected per day; and air freight diverted to commercial hubs in Riyadh, Abu Dhabi, Dubai, Muscat and others. Aviation disruptions widened further on 23 June, when, at the height of regional tension, Iran responded to US strikes on its nuclear sites by attacking the US Al Udeid Air Base outside Doha in Qatar. For Qatar alone, its subsequent eight-hour airspace closure resulted in diverted flights for more than 20,000 inbound passengers, while 10,000 more were stranded at Doha’s Hamad International Airport. Other Gulf states, Kuwait, Bahrain and the UAE, also briefly suspended air travel. One passenger flight from Perth to Paris was forced to turn around over the Arabian Sea due to “additional airspace closures and congestion through the Middle East,” returning to Perth 15 hours after take-off. Another Australian flight was diverted from its path to London that same day, instead landing in Singapore.

Into the grey-zone

With the 24 June ceasefire in place, airspaces and airports have reopened, and oil prices and freight costs have moderated. However, the longstanding differences between Iran and Israel are by no means resolved. The conflict has simply returned to the “grey-zone,” fought by third party proxy groups, and through covert and asymmetric tactics, with commercial and civilian infrastructure remaining a prime target. For Iran, this likely means ongoing attacks by its regional network of allied armed groups. In July, for instance, the Yemen-based Houthi rebels resumed attacks on commercial ships in the Red Sea, with direct strikes on two Greek-owned oil tankers; and on 20 July, Israel’s Eilat Port suspended operations due to lost revenue and unpaid debt as a direct result of ongoing maritime insecurity in the region. Several Western-operated oilfields in northern Iraq have suspended operations too, following successive drone attacks by irregular armed groups. We may also see Iran deploy other tactics in the coming months, like the detention of foreign ships and their crews for leverage in international talks; or cyberattacks and sabotage on third country infrastructure. Israel, too, is an expert at clandestine warfare, with extensive and highly sophisticated intelligence networks throughout the region. Since 24 June, for example, there have been a string of explosions at residential buildings across Iran, initially attributed to gas leaks, but raising speculation of Israeli involvement.

Should open conflict between Israel and Iran resume – or escalate and spread across the region – in the months to come, the disruptions to business would again be significant. In a worst-case scenario, airspace closures would become prolonged across the region, and ports, airports, and aircraft would present attractive targets for direct attack. Oil and gas production and processing facilities – and other energy infrastructure – would come under fire, sending global fuel prices up. And while it remains a last resort, Iran may follow through on its threat to close the Strait of Hormuz, compounding disruptions for the global oil trade. This scenario, at its most extreme, may not come to fruition, but persisting tensions will nevertheless continue to drive periodic disarray to shipping and aviation through the region over at least the year to come.