The First 100 Days – An Assessment of Ethiopia’s Abiy Ahmed’s Time in Office

The new leader, appointed on 2 April, has embarked on a vigorous reform campaign, seeking to open up Ethiopia’s political and economic environments. Thus far, PM Abiy has lifted the countrywide state of emergency, announced plans to liberalise the economy and confirmed that the Ethiopian government will implement the 2002 Border Commission ruling signed with Eritrea without any amendments or preconditions. These steps, among several others, have encouraged widespread optimism among Ethiopians, both at home and abroad. Meanwhile, plans to privatise key sectors of the economy, including the aviation and telecommunications sectors, together with efforts to diversify away from agriculture, have been welcomed by potential investors. While PM Abiy’s approach is promising, there is some uncertainty over the degree of support he has in the ruling Ethiopian People’s Revolutionary Democratic Front (EPRDF) coalition, specifically from hardliners in the Tigray People’s Liberation Front (TPLF), and whether this fast-paced approach will be sustainable.

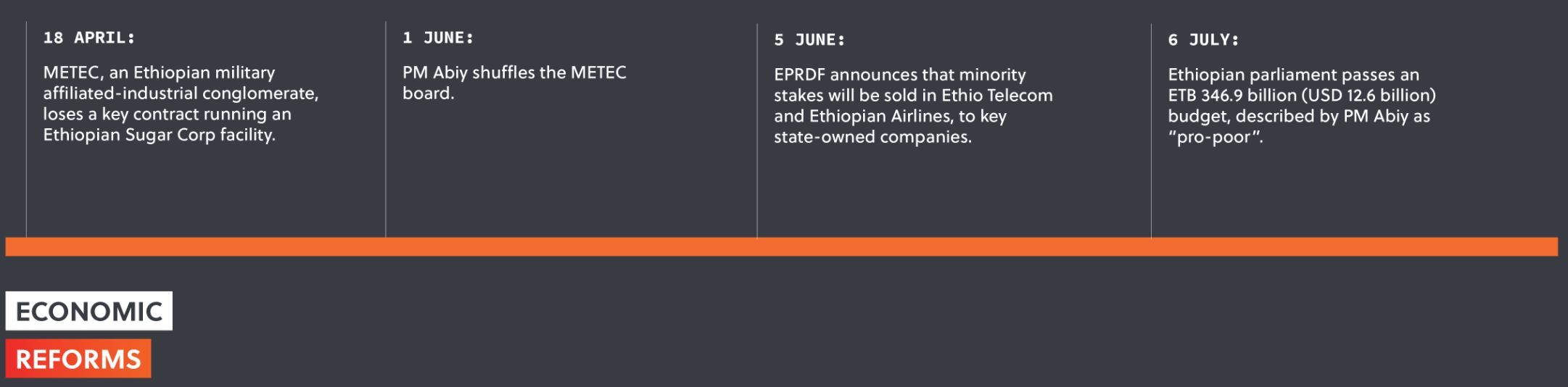

PRIVATISATION

PM Abiy’s government has announced plans to liberalise the economy, including wholly and partly privatising state-owned entities (SOEs) in the aviation, energy, telecommunications and manufacturing sectors. Private investors will reportedly be able to acquire minority shares in strategic assets such as Ethiopian Airlines and Ethio Telecom. Furthermore, the government has demonstrated the intent to hire foreign companies to develop Ethiopia’s sugar industry, after cancelling a military-industrial conglomerate’s contract on Ethiopia Sugar Corp’s strategic Tana Beles II project in the Amhara Region. The government had halted military-run Metals and Engineering Corp (METEC)’s role in the project “because of poor performance and delay,” in a significant display of renewed resolve to improve delivery. PM Abiy’s administration further reduced the military control of METEC, appointing Ambachew Mekonnen as chairperson. Mekonnen succeeds interim chair Demeke Mekonnen, who replaced long-serving chairperson, Siraj Fegessa, then Minister of Defence. Although this falls short of the immediate establishment of a competitive open market, it is a positive step in addressing the country’s foreign debts and easing import bottlenecks. Yet, it is clear that the government was pressured into the move in response to severe foreign reserve shortages and there remains significant uncertainty regarding how and when this privatisation programme will be rolled out. Logistical challenges persist, including a closed banking sector, a corrupt foreign exchange regime and the ongoing domination of military or state owned conglomerates, which will likely frustrate early investors and dampen optimism over opportunities in Africa’s second fastest growing economy. Furthermore, the heavily indebted government may in turn choose to partition off SOEs to its creditors in an effort to combat mounting debt. Early improvements in corporate governance in SOEs will drive a greater need for due diligence requirements for early investors, as this remains a somewhat rushed policy turnabout on the part of the Ethiopian government, one that will need some time to be accurately evaluated.

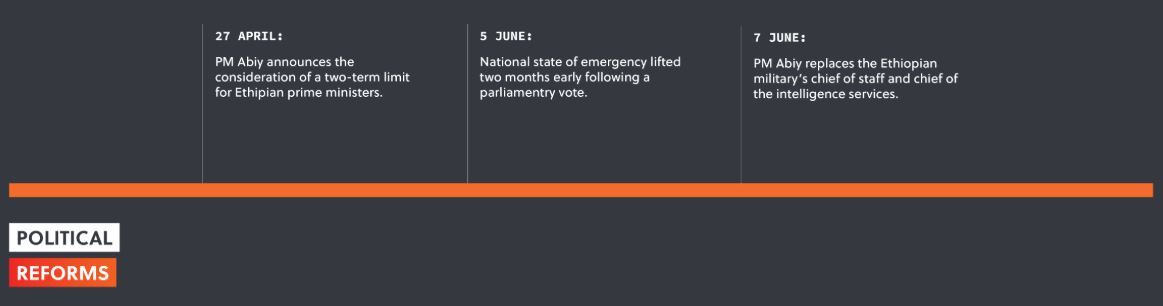

POLITICAL PARTICIPATION

PM Abiy has also taken significant steps to open up Ethiopia’s political environment, releasing political prisoners, unbanning opposition parties and closing the notorious Maekelawi detention facility, known to be a site of government-initiated human rights abuses. He has also made promises to reform the justice system and address the demands of communities who engaged in widespread protests over 2016/2017. As head of the Oromo Peoples’ Democratic Organisation (OPDO), PM Abiy enjoys the support of the Oromo faction of the EPRDF and Oromo communities, while early apologies for the recent violent unrest in the country in 2016/2017 has gained him favour with coalition member, Amhara National Democratic Movement (ANDM), and its supporters. Meanwhile, the parliamentary backing of the decision to remove three armed opposition groups from the country’s list of terrorist organisations has been well received by supporters of the Oromo Liberation Front (OLF), Ogaden National Liberation Front (ONLF) and Ginbot 7. This followed the 22 June announcement by Ginbot 7 to suspend its armed resistance, with the group spokesperson stating the PM Abiy’s reforms indicated that “genuine democracy” may be “a real possibility”. The lifting of the state of emergency implemented following the resignation of former prime minister, Hailemariam Desalegn, on 15 February, coupled with the unblocking of over 100 websites and TV channels, has also served to open up political space in the country. Again, while positive, it is unlikely that such tolerance to the opposition will by stomached by hardline members of the TPLF as the 2020 elections edge closer. PM Abiy will need to maintain his emboldened and fast-paced approach to politics to push back on internal criticisms.

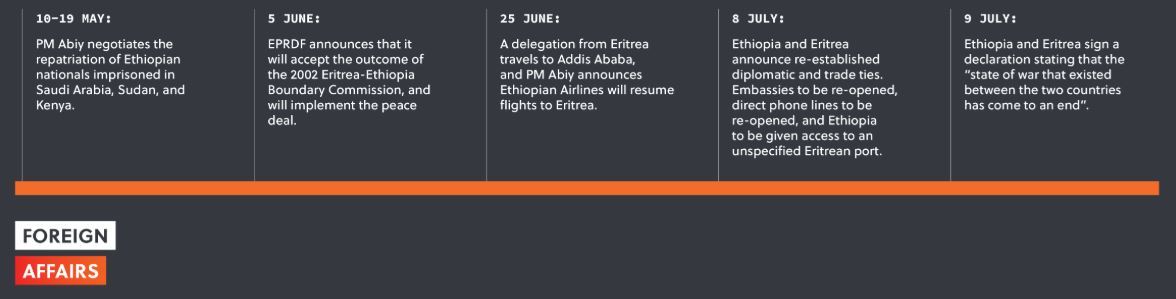

PEACE DEAL

In another brazen move, PM Abiy’s government announced that the country will proceed with the implementation of the border demarcation between Eritrea and Ethiopia as outlined in the 2000 Algiers Agreement and the 2002 Border Commission signed with Eritrea. The two countries have since signed a “declaration of peace and friendship” on 8 July. The declaration makes provisions for transport, trade and telecommunication ties to be renewed. The decision to travel to Asmara demonstrated a confidence on the part of PM Abiy to directly engage President Isaias Afwerki and the Eritrean government, largely circumventing the EPRDF. The two leaders agreed to reopen embassies, and restore flight links and telecommunications between the two countries. Ethiopia will also reportedly be allowed access to one of Eritrea’s two ports. Despite being a clear watershed moment between the former adversaries, the details of the deal still need to be determined, specifically regarding the border between the two countries. These emboldened gestures of resolution can easily be undone by grassroots hostilities. There is little available information on the receptiveness of the regional level governments of the Tigray and Afar regions to the border demarcation and the attitude of the rank-and-file military, who will likely be responsible for the demarcation roll-out, is also uncertain.

REGIONAL PARTICIPATION

Ethiopia has also increased ties with the United Arab Emirates (UAE), with the latter pledging USD 1 billion to Ethiopia’s Central Bank as part of USD 3 billion investment deals. This ties Ethiopia to its Saudi Arabian ally and effectively places the country on the Saudi side of the ongoing Gulf Crisis. This will offer Ethiopia some regional influence as the country looks to bring the long awaited Grand Ethiopian Renaissance Dam online. Although these deals have occurred in the past, the move will facilitate the opening of significant investment opportunities for UAE entities. Yet, regional dynamics remain fluid as tensions between Qatar and the Saudi-led bloc in the Gulf Cooperation Council continue to fluctuate. It is clear, however, that these deals, mean Ethiopia is no longer a neutral player.

OUTLOOK

It is clear that dynamics are changing in Ethiopia, and there is a moderate likelihood that the power structure within the EPRDF is shifting. PM Abiy has effectively used the EPRDF power apparatus and capitalised on Ethiopia’s recent unrest to secure a positon from which to effectively drive reform. PM Abiy’s popularity, coupled with plans to privatise SOEs that serve as key revenue funds for the political elite, could jeopardise PM Abiy’s ability to consolidate his support in the EPRDF, particularly ahead of the 2020 elections, with TPLF elites unlikely to sacrifice lucrative patronage networks in favour of economic and political reform. A divided EPRDF will be hesitant to participate in truly competitive elections, while a proclaimed reformist ruling coalition cannot shy away from one. It appears increasingly evident that a power shift has occurred within the federal government and within the EPRDF. The question now is whether this federal level shake up will be sustainable, and, perhaps more importantly, accepted at a regional level and within the military. PM Abiy has already demonstrated an intent to tackle these two challenges head on. He is aiming to stamp his mark on the military amid strong nationalist rhetoric, having already replaced military chief of staff, General Samora Yunis, on 7 June. Yet, it remains to be seen whether this can be mirrored at the lower ranks and at a local governance level. Ultimately, 100 days in office is an insufficient time to assess whether PM Abiy can rely on his rhetoric, personality and popularity to maintain his reformist agenda in the long term. While the outlook for the country is positive, PM Abiy still faces significant hurdles in achieving all he has promised. He does, however, appear determined to do so.