Geopolitical games: The uncertainties underlying global power dynamics in 2023

The longstanding global order is under threat. A prolonged conflict between Russia and Ukraine, growing concerns around China’s claims over Taiwan and the Taiwan Strait, and elevated US-Saudi tensions over oil supplies look set to be the drivers of geopolitical risk in 2023. The prospects for stakeholders to respond irrationally or disproportionately through military escalations in Europe and Asia Pacific, or Russia’s wavering commitment to its grain export deal with Ukraine, will cast a shadow of uncertainty over the global operating environment. Businesses will face challenges in the form of supply chain disruptions, oil price increases and greater inflationary pressures which could in turn instigate political violence risks ranging from civil unrest, political instability, and in an extreme case, war.

DRIVERS OF GEOPOLITICAL UNCERTAINTY IN 2023

RUSSIA’S WAR IN UKRAINE

Russia’s military operation in Ukraine is fast becoming a protracted conflict. While Russia remains undeterred in its resolve to retain annexed territories and potentially expand them, Ukraine’s gallant commitment to recapture its territory has done little to pave the way to a peaceful resolution. Adding to these tensions, in 2023, inherent uncertainty will stem from US and NATO support for Ukraine. Firstly, support will enable Ukraine to bolster its military defence. And, beyond the battlefield, Russia’s ability to weaponise regional gas supply and waver in its commitment to Ukraine’s grain export deal will raise instability across Europe. Supply chains across the region will be disrupted, economic challenges magnified, and the cost-of-living crisis exacerbated across the region. Secondly, and arguably of greater concern, is the potential for direct NATO involvement in the conflict. In November 2022, the accidental landing of a missile in Poland exposed the reality of miscalculation amid heightened tensions beyond Russia-Ukraine borders. Combat fatigue and weakened defences will further drive the potential for battlefield errors and accidents.

CHINA-TAIWAN-US TENSIONS

Unsettled by Russia’s invasion of Ukraine, the US and its allies have heightened economic, military and diplomatic initiatives to counterbalance the potential for conflict in Asia Pacific amid fears of a Chinese move on Taiwan. China’s enhanced military presence in waters surrounding Taiwan, along the Taiwan Strait and in the South China Sea seen in 2022 has raised the perceived threat to freedom of navigation in the region’s key shipping routes, prompting the US, Japan, Australia and South Korea to increase their military presence in the disputed waters. Intensified military posturing in the region over the course of 2023 will sustain the risk of unintended military collisions and consequential disruptions across regional trade distribution networks.

Beyond military intensification, US-led initiatives in 2023 will introduce considerable fragility to the US-China relationship. The US Senate and House of Representatives will deliberate the Taiwan Policy Act (TPA), which if passed without amendments would signal the US veering away from its ‘One China’ policy . Further, US efforts to counterbalance China’s global influence will remain focused on decoupling strategic sectors from reliance on China, including through greater sanctions. The US’s initiatives run in parallel to the renomination of Chinese President Xi Jinping for an unprecedented third term, which will embolden China’s regional military objectives and divergence from the West. These competing elements cumulatively set the course for strained China-Taiwan-US relations in the year ahead.

US-SAUDI RELATIONS

With ambitious (and costly) plans to diversify its economy away from oil and to accelerate its energy transition efforts, Saudi Arabia has a vested interest in ensuring energy prices remain high. In October 2022, amid rising global inflation worries, Saudi shocked global markets in an agreement with Russia to decrease OPEC+ oil production and in turn maintain elevated energy prices. From an economic standpoint, high energy prices contend with US concerns around global energy stability and inflation. More importantly, from a geopolitical perspective, cooperation between Saudi and Russia will challenge US efforts to isolate Russia from the global economy. Higher energy prices further provide Russia with the ability to raise revenues to fund its military ambitions.

To avert Saudi cooperation with Russia, 2023 is expected to feature increased attempts from the US to rebuild ties with Saudi. President Joe Biden’s administration has already reversed its promise to penalise the Saudi government for its injustice towards journalist Jamal Khashoggi, and has instead called for immunity to be extended to the crown prince, Mohammed bin Salman (MBS), over the atrocity. Caught between its self-interests, the US’s motivations and Russia’s ambitions, as well as MBS’s own agenda for the Kingdom’s future, means that Saudi’s geopolitical engagements in the global arena will bring further unpredictability to energy markets.

WHAT IS ON THE HORIZON FOR BUSINESSES IN 2023?

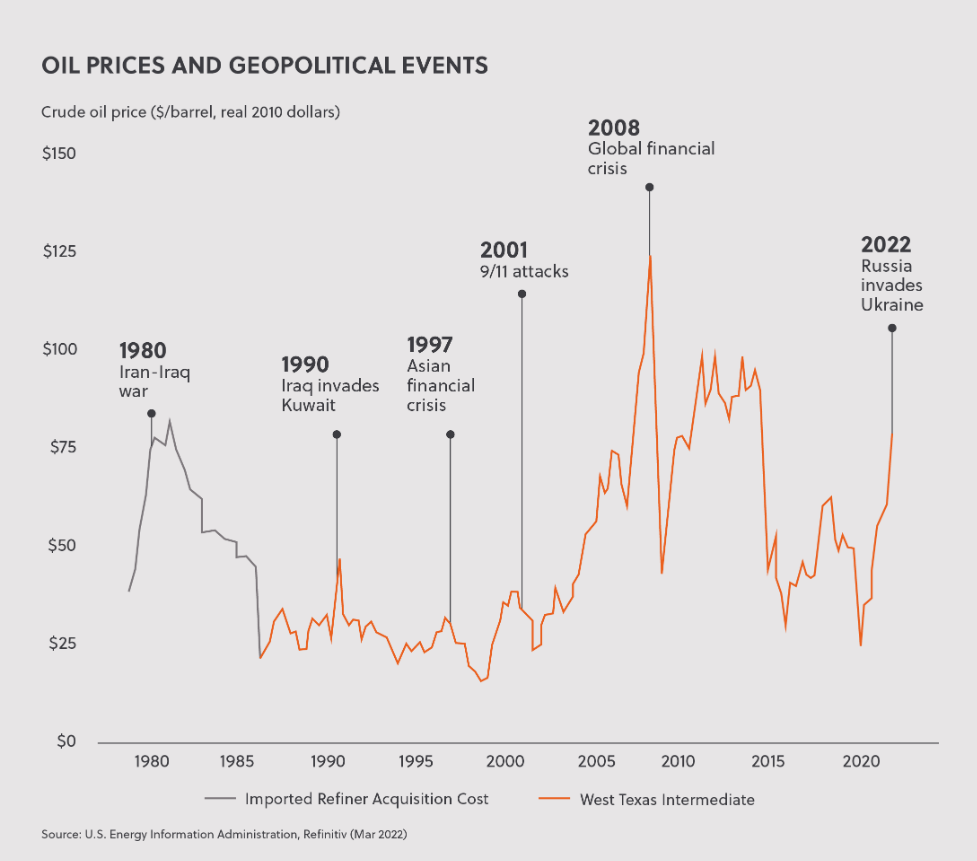

While varying outcomes remain possible across these pivotal relationships, historical periods of elevated geopolitical uncertainty provide some indication around the challenges we can expect in the coming year.

ENERGY INFLATION WILL CONTINUE TO PERSIST

Notwithstanding Saudi-led oil production cuts and Russia wielding gas supply for leverage, geopolitical uncertainty has historically created upward pressure on energy prices and downward pressure on energy supply. Energy-importing countries and energy-intensive industries will continue to face inflation and cost-related challenges as energy prices remain elevated. Energy inflation and its growing cost of living implications will in turn accelerate the pace of energy transition investment, as we are already seeing across Europe.

TEMPERED INVESTMENT

Decision making in a world rife with geopolitical risk will be limited as business executives and investors increasingly postpone investment decisions to avoid unpredictability across new business endeavours. In China, international investors have already put off in-country and regional expansion plans against the backdrop of China facing greater US and Western scrutiny. Similar investment moderation across the three regions, Europe, Northeast Asia and the Middle East, embroiled in geopolitical tensions will weigh on global growth prospects.

RISING INSURANCE PREMIUMS

In 2022, businesses operating in China reported a rise in political risk coverage premiums by more than 60 percent due to heightened regional tensions. As geopolitical uncertainty intensifies, the potential for regional disruption will raise business operating costs beyond China to insure operations against the risks associated with geopolitical fallout.

HEIGHTENED POLITICAL VIOLENCE RISKS

The unpredictability of geopolitical skirmishes could exacerbate challenges for countries already beset by cost of living issues, debt crises, political instability and regime change. For instance, geopolitical entanglements risk undermining cooperation between China, Japan, and India to restructure Sri Lanka’s debt, which would worsen the country’s economic crisis. In extreme cases, geopolitical miscalculations and disproportionate responses hold the potential to instigate war or prolonged civil unrest in some countries.