A Crude Reality: Security Risks and the Oil and Gas Sector

The global oil and gas exploration and production industry generated about USD 2 trillion in revenue in 2018, with some initial signs of recovery following years of depressed oil prices and oversupply. Although market conditions have improved, several industry players continue to face persistent operational risks unique to the security landscape of their operating environments. In fact, a favourable economic outlook for the sector will draw the attention of numerous criminal and non-state actors, each looking to carve out their share of the profits.

NIGERIA

According to the UN Office for West Africa and the Sahel, Nigeria suffered a loss of nearly USD 2.8 billion in revenues in 2018 due to oil-related crimes. Persistent and entrenched insecurity, including militancy, kidnapping and vandalism, in Nigeria’s oil producing Niger Delta has created a permissive environment for rampant criminality.

Militancy

Although unrest in the Niger Delta has significantly decreased since the March 2016 emergence of the Niger Delta Avengers (NDA) militant group, it remains uncertain if the government brokered truce will hold. Recently, the NDA was quick to renew threats against the Buhari administration during the February 2019 elections. Other groups made similar threats in May amid a planned arraignment of the Chief of Justice over corruption allegations. While this does not necessarily translate into an immediate threat of renewed attacks against oil infrastructure, the threat remains credible as militants become increasingly frustrated with the Buhari administration.

Crime and Kidnapping

Meanwhile, criminal groups continue to operate with impunity; they are engaged in a diverse array of criminal activity, ranging from illegal oil bunkering, trafficking and kidnappings. Kidnappings in the region have targeted oil workers, including those employed by multinational companies. In December 2018, for example, as part of the security exercise Operation Delta Safe, the Joint Military Task Force released seven captured oil workers. The oil workers, employed by the subsidiary of a large multinational firm, had been kidnapped on site in Azuama in Southern Ijaw Local Government, Bayelsa State. While most kidnapping cases involve the local employees of Nigerian and international oil companies, expatriate workers have also been targeted.

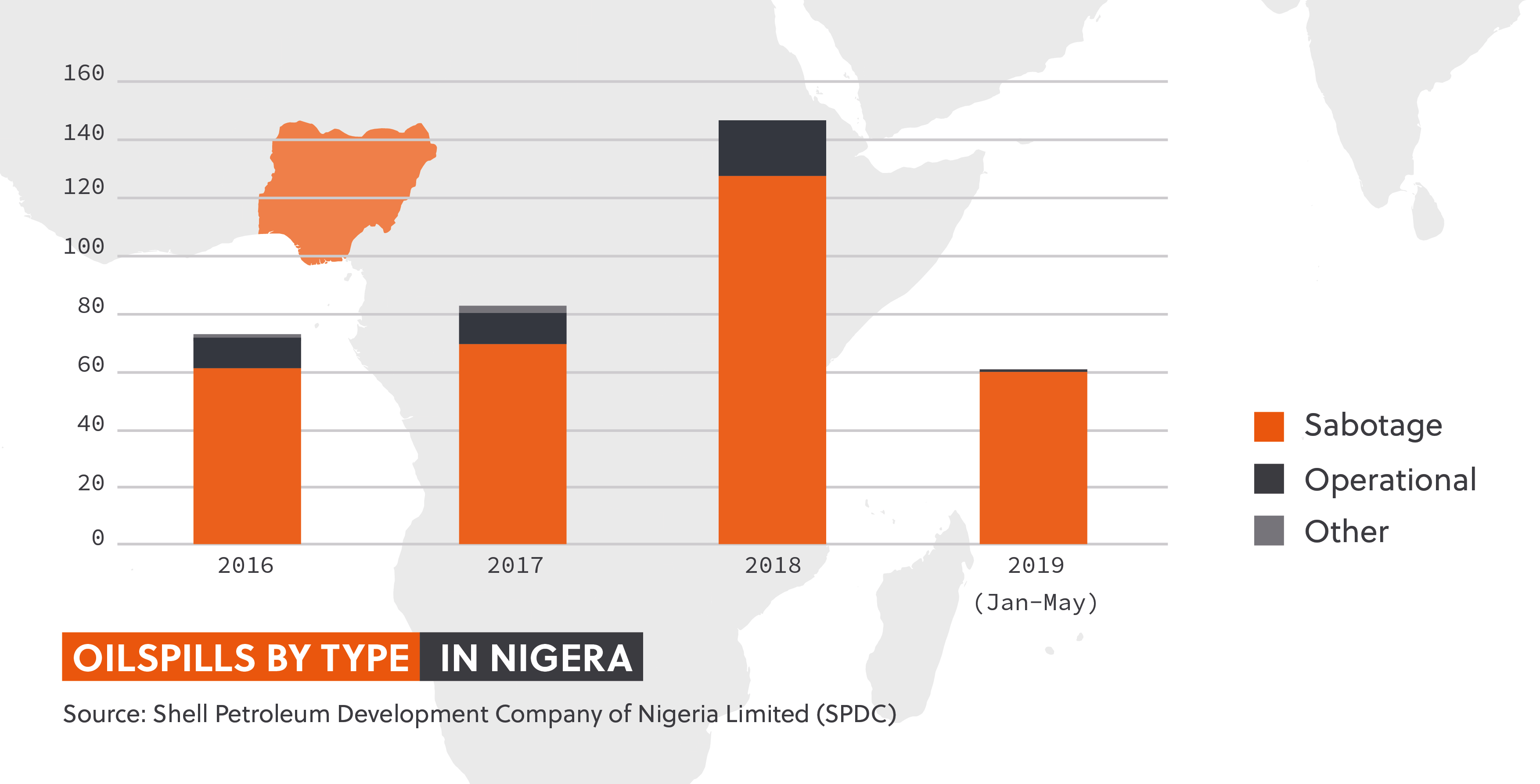

Sabotage

Sabotage, particularly targeting oil pipelines, remains pervasive, accounting for about 80 percent of oil spills according to the estimates by commercial operators in the region. Many international oil firms have also repeatedly cited the detrimental environmental impacts of oil spills as a consequence of sabotage, as well as the associated impact on the sector’s reputation and the operational costs of extended shutdowns. Yet, the black market for oil is thriving. With the well-documented collusion of local politicians and other power brokers, there is an absence of political will, particularly at the local level, to combat this illicit activity.

MEXICO

Fuel theft in Mexico is a billion-dollar industry. Mexico’s state-owned oil company, Petróleos Mexicanos (Pemex), has reported a steady increase in illegal tapping along its pipeline network. According to Pemex, the number of illegal taps rose from 132 in 2001 to 12,581 in 2018. Both an increase in the price of fuel and the completed liberalisation of fuel prices in December 2018 have bolstered fuel thefts along pipelines and from tanker trucks.

The Perpetrators

Large cartel organisations, such as Jalisco Nueva Generación and Cártel de Santa Rosa de Lima, have become increasingly involved in fuel thefts. They do so either by stealing fuel from depots, transport vehicles or refineries directly, or through the collaboration and control of socalled "huachicolero bands". The term is used in Mexico to designate people who steal or sell fuel illicitly.

Competition

Because smuggling and selling fuel is a simpler enterprise than dealing in illegal drugs, inter-cartel violence over fuel has increased. Fuel thefts have been concentrated in the states of Guanajato, Hidalgo and Puebla, and a notable rise in Guanajato’s homicide rate has been directly attributed to gang turf wars driven by attempts to control the stolen fuel market. While 957 homicides were reported in the state in 2015, this figure rose to 3,290 in 2018.

Government Response

In response to the ongoing security challenges around fuel theft, in December 2018 Mexico’s President Andrés Manuel López Obrador launched a crackdown to stop illegal taps, ordering a temporary closure of Pemex pipelines. The move resulted in widespread fuel shortages in many parts of the country, which are expected to continue at least in the short term. As if to underscore the problem, on 19 January, a fuel pipeline, reportedly ruptured by thieves, exploded in Tlahuelipan, Hidalgo state, killing at least 135 people. Obrador’s government insists that the shutdown has significantly reduced fuel thefts and that fuel supplies are in the process of being normalised despite the inconvenience to motorists.

In April 2019, Obrador, alongside Pemex CEO Octavio Romero Oropeza, announced that average daily fuel theft had declined by 95 percent over the last six months. The government has also made efforts to transport fuel via trains and trucks, and has worked on improving security measures around pipelines.

LIBYA

Entrenched Insecurity

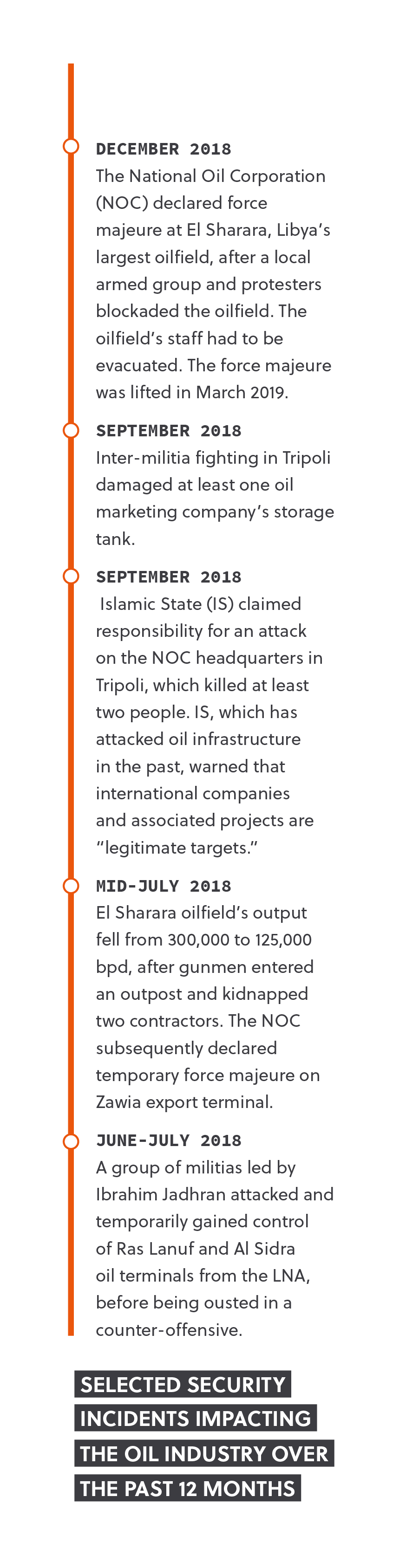

Insecurity, underpinned by the country’s deep political divisions and armed conflicts since the 2011 Revolution, continues to hamper Libya’s hydrocarbon production and exports. Although Libya’s oil production reached 1.278 million barrels per day (bpd) in 2018 — the highest since 2013 — various security challenges have precluded consistent output at such levels. These security challenges include:

- Pipeline blockades,

- Thefts,

- Kidnappings,

- Terrorist attacks,

- Protests that halt production,

- Armed conflict, and

- Attempts to seize facilities by force, which have occasionally damaged oil infrastructure.

Armed political, tribal, militant, terrorist and even familial groups continue to threaten and attack oil facilities to attain leverage to secure funding, settle disputes, gain political advantage and undermine rivals.

Commercial Impact

Persistent insecurity in the country has significant commercial implications as well, as it complicates the return of oil and gas companies that have left or reduced their operations in Libya. It also prolongs delays in the much-needed repair of oil infrastructure, due to the inability or unwillingness of specialist engineers to operate in certain areas of Libya and difficulties in moving equipment securely across the country.

Protection and Control

To overcome these challenges, the authorities will have to guarantee adequate security at various production sites and export terminals, where expatriate employees will potentially be working. However, there are few professional, bureaucratised and accountable security forces in Libya, which inevitably means that irregular militias are often in charge of providing security. Militia security guarantees are occasionally ineffective, as demonstrated by several expatriate kidnappings from remote sites in mid-2018.

Furthermore, there is no central government in Libya, as the country continues to be run by two rival governments based in western and eastern Libya. The eastern-based Libyan National Army (LNA), which controls most oil fields and terminals in Libya, also launched a military operation in April 2019 to oust the Tripoli-based Government of National Accord (GNA) and affiliated militias. While this has not yet led to any major disruptions to oil production and export, the potential for such remains, as some oil infrastructure experienced collateral damage from the clashes. The LNA remains a polarising entity with many adversaries in Libya. These adversaries are likely to continue to view the LNA, as well as assets it controls, as viable targets to attack. Beyond these security challenges, the threat of operational disruptions by local communities with longstanding socioeconomic grievances will also persist in the foreseeable future.