What to expect from the upcoming Mexican elections

Mexico will be holding its general elections on July 1, when Mexicans will elect, on a federal level, a new president to serve a six-year mandate, 128 senators and 500 members of the Chamber of Deputies, with local elections also taking place in Mexico City and in 29 out of Mexico’s 31 states.

The 2018 elections are understood to be one of the most decisive for Mexico, with approximately 88 million Mexican registered voters. A broad perception of the country’s poor economic performance in recent years, combined with persistent levels of poverty, inequality, and, most notably, rising levels of violence and criminality, prompt a general willingness for new policies and governmental change.

BACKGROUND

Mexico was ruled by the Partido Revolucionario Institucional (“PRI”) from 1929 to 2000, when the opposition party Partido Acción Nacional (“PAN”) gained power. In 2012, the PRI regained its grip with the election of Enrique Peña Nieto (“Peña Nieto”) to the presidency. Mexico’s presidential term limit is one six-year term, which ends this year for the incumbent president.

Peña Nieto’s administration has been hounded with allegations of impropriety, including his implication in corruption scandals along with several other PRI politicians. In 2014, for example, Peña Nieto was accused of having received a house (the now-infamous ‘Casa Blanca’), then-valued at USD 7 million, in exchange for illicitly awarding public contracts to a construction company, Constructora Teya SA de CV. However, despite significant pressure and media coverage on the allegations against him, Peña Nieto managed to avoid legal proceedings in connection with this.

His administration, albeit controversial, demonstrated, in its initial years, nominal efforts in combatting the country’s endemic levels of corruption and organised crime. An early victory was the arrest of the notorious Sinaloa cartel leader, “El Chapo”, in 2014. However, throughout 2014, this perception started to fade away due to a new rise in the levels of violence and crime, gaining further impetus with El Chapo’s escape from prison in 2015. His recapture in 2016, in a joint effort by Mexico and the US, did little to repair the administration’s image as a strong proponent of efforts to combat corruption and organised crime.

Peña Nieto’s market-friendly but unpopular energy sector reform in 2013, concerns with Mexico’s rising levels of inflation, unemployment, corruption, violence and organised crime have led to declining approval rates for Peña Nieto. His administration’s involvement in corruption scandals and allegations of impropriety has also significantly weakened PRI’s reputation as a whole.

The rising levels of violence are likely to be a key factor impacting expected voter turnout in Mexico. Regions where crimes are directly associated with drug cartels have had lower voter turnout in past elections.

MAIN ISSUES

As official campaigning kicked off in Mexico on March 31, candidates have structured their campaigns around the following main issues:

Corruption. Candidates have focused a large portion of their speeches against the rampant corruption ingrained in the country’s institutions. Mexico ranks amongst the countries with the highest perceptions of corruption. For instance, on Transparency International’s 2017 Corruption Perceptions Index, Mexico ranks 135 out of 180, with 1 being the least corrupt, and 180 being the most corrupt. The need to fight corruption appears to be a common platform among the 2018 presidential candidates.

Institutional independence. Candidates broadly support a campaign against corruption through the promotion of measures such as the independence of the Public Prosecutor’s Office and the elimination of prosecutorial privileges of senior politicians in Mexico. Institutional independence, which is generally weak in the country, is seen as a fundamental change issue, as politicians and public officials are frequently entangled in allegations of corruption, fraud or money laundering but tend to not be prosecuted, thus contributing to a perception of impunity in the country.

Violence and organised crime. Severe levels of violence are a key factor in this year’s elections. According to Mexico’s Secretariat of National Security, homicide rates in the country went up from 17.1 homicides per 100,000 inhabitants in 2015, to 26.9 homicides per 100,000 inhabitants in April 2018.

The rising levels of violence are likely to be a key factor impacting the levels of voter turnout in Mexico. Regions where crimes are directly associated with drug cartels have had lower voter turnout in past elections, which typically ranged from 50 to 65-percent. Nevertheless, low turnout due to violence is unlikely to jeopardise the chances of any particular candidate.

Economy. Given Mexico’s slow-paced economy, candidates have dedicated a significant, albeit smaller, portion of their agendas to addressing economic strategy, with a specific focus on the North American Free Trade Agreement (“NAFTA”). As recent discussions indicate potential significant changes to the agreement, candidates sought to propose alternatives. Their proposals range from frontrunner Andrés Manuel López Obrador’s (“AMLO”) support of inward and nationalistic economic policies, to runner-up Ricardo Anaya Cortés’s calls for strengthening Mexico’s relationship with the US and encouraging international trade.

However, the extent to which drastic policy changes can be implemented will depend on majority or two-thirds-majority legislative approval. Mexican political commentators have noted that major shifts in current economic policies, such as Peña Nieto’s energy reforms, are unlikely as many would require a two-thirds majority congressional approval.

KEY CANDIDATES AND THEIR ANTI-CORRUPTION MESSAGES

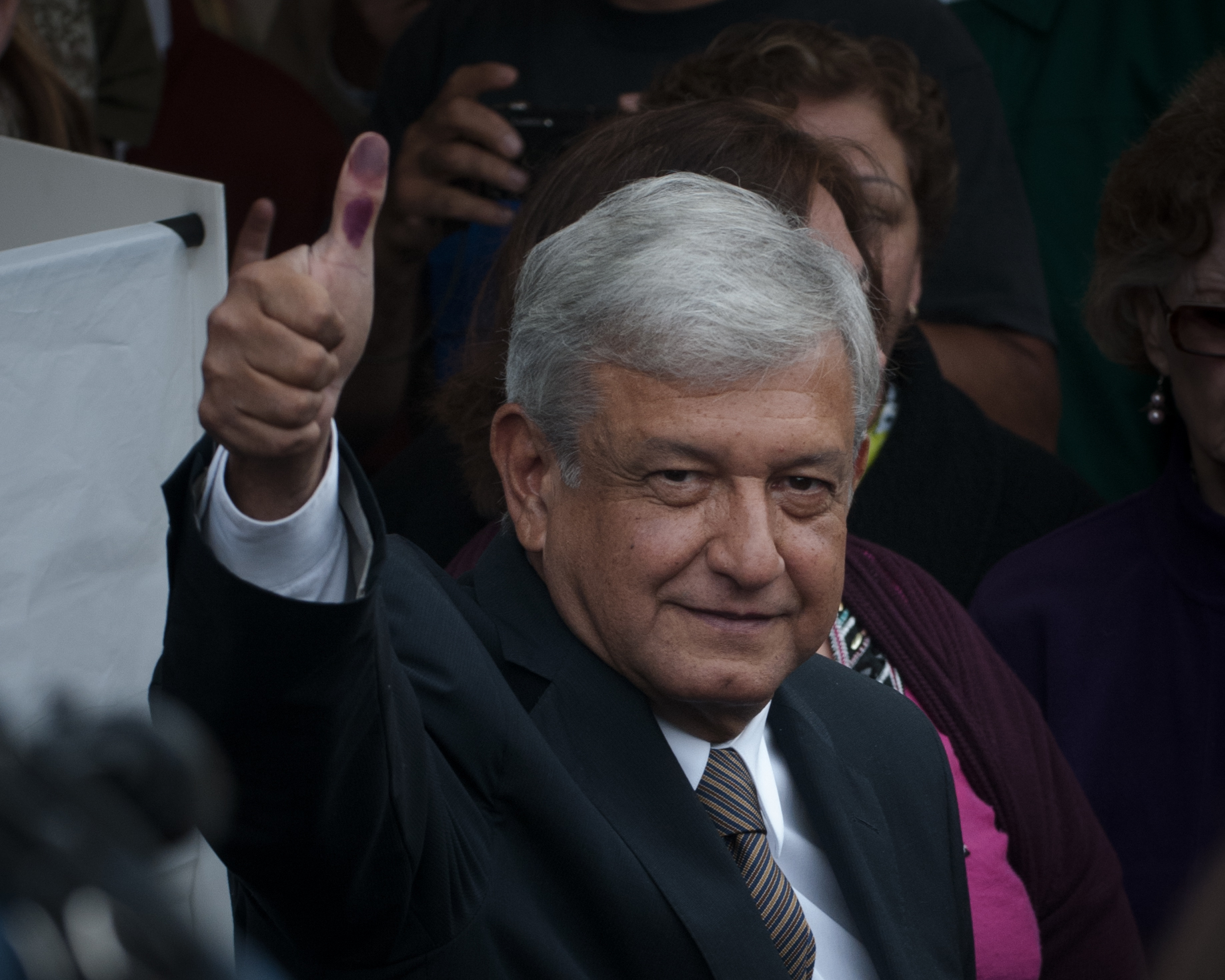

Andrés Manuel López Obrador (“AMLO”). The left-wing frontrunner, with an expected 46-percent of voter intentions as of May 30, representing the leftist party Movimiento Regeneración Nacional (“Morena”). AMLO is no stranger to Mexican politicians, having been mayor of Mexico City from 2000 to 2005, and losing the 2006 and 2012 presidential elections by narrow margins. AMLO portrays himself as an unimpeachable corruption fighter. His main promises on the anti-corruption front are: - Abdicate the president’s prosecutorial immunity; - Tighten control methods against money laundering through investigations on shell companies as well as collaboration with international agencies to fight tax havens; - Make all tenders publicly-available online, with real-time streaming to allow their monitoring.

Ricardo Anaya Cortés (“Anaya”), polling at 30-percent of the expected votes and representing PAN, this is Anaya’s first presidential campaign. Anaya’s platform mainly spins around proposing the strengthening of Mexico’s rule of law and a hard stance against corruption and organised crime. He indicates these should be accomplished through transparency, institutional reforms, an independent Attorney General, severe punishments against parties convicted for corruption and fraudulent practices. Among his proposals are: - Public officials, politicians and companies that have been convicted of corrupt practices will be forbidden from bidding and contracting with the public administration. Individuals convicted will also not be allowed to occupy public office; - Eliminate prosecutorial privileges for all elected public officials and politicians, the president included, which would allow these individuals to be indicted and put on trial during their tenures; - Prohibit the use of cash in any type of governmental transaction and for any government office that transacts with private parties.

José Meade Kuribreña (“Meade”), with an expected 21-percent of vote intentions, this is Meade’s first run for presidency, representing PRI. Meade served as the secretary of Finance and Public Credit of Mexico from 2016 to 2017. Political commentators describe his candidacy as tainted by his party’s image, as numerous individuals affiliated with PRI have been involved in corrupt practices, which is likely to jeopardise his candidacy. His main proposals are: - Establishing as obligatory the filing of an annual form for high-level public officials to declare their assets, interests and taxes; - Confiscation of assets of corrupt public officials, which would then be destined for scholarships and crime prevention programmes; - Abdicating the president’s immunity from prosecution. Jaime Heliódoro Rodríguez Calderón (“Rodríguez”), with an expected 3-percent of vote intentions is running, for his first time, as an independent candidate for the presidency. Rodríguez is seen by commentators as a more radical candidate, adopting more severe approaches against corruption and crime, such as his suggestion that corrupt politicians and drug traffickers should be punished by having their hands cut off.

FORMER CANDIDATE

Margarita Zavala Gómez del Campo de Calderón (“Zavala”) had 4-percent of vote intentions, running as an independent candidate. Zavala dropped out of the race on May 16. Given her previous affiliation with PAN, political commentators have indicated the likelihood of the majority of her voters transferring their support to Anaya. Nonetheless, as of the writing of this article, it is still unclear who her expected-voters will likely support.

POTENTIAL CHANGES TO MEXICO’S ANTI-CORRUPTION AND COMPLIANCE LANDSCAPE

Despite the differences between candidates, we assess that stronger efforts to combat corruption, impunity and criminality in the country are a common platform among the main presidential contenders.

Transparency has been a frequent word in Mexico’s 2018 elections, which indicates that politicians and candidates are aware of the need to implement new governmental procedures that would allow improvements in anti-corruption measures and stronger compliance efforts throughout the country. Significant changes in the transparency and functioning of public tenders are to be expected, with the possibility of enactment of publicly-available systems that could allow citizens to monitor public tenders.

These measures, allied with calls to defend the independence of the Prosecutor’s office, the ending of the presidential prosecutorial immunity and further efforts against impunity in the country, indicate that public and prosecutorial scrutiny over opaque dealings in prominent sectors, such as infrastructure, construction, and oil and gas, will be significant. While there is no telling if this trend will spur more stringent government anti-corruption measures or trickle down to the local level, investors should be attentive when selecting local partners or developing projects on the ground. Transactions that involve state-owned entities, impact communities or the environment, and demand close coordination with local governments will be especially prone to media, regulatory, and popular scrutiny in the short to medium term.