Impoverished Millionaires: Prospects for Civil Unrest Amid Hyperinflation in Venezuela

International financial institutions estimated in July this year that Venezuela’s inflation rate will rise to 1 million percent by the end of 2018. Just three months earlier, in April, the figure was put at a far more modest, though still staggering, 13,000 percent. The near record-breaking inflation rate has been driven by failed economic policies, high levels of corruption, and the collapse of the domestic oil industry. Shortages of food and other vital goods have become commonplace, as have related protests.

Venezuelans frustrated by the government’s failed efforts to stabilise the economy and improve service delivery, have taken part in protests in the past 18 months, which, in several instances, have turned violent. While the frequency and scale of protests have dwindled since the end of 2017, four consecutive years of recession, coupled with perceptions of the government’s inadequate response to dealing with the economic crisis, raises the potential for significant economic and political instability that will likely drive further unrest.

Venezuela’s oil revenues account for approximately 95 percent of its export earnings. As a result, the decline of the national oil industry has had a substantial impact on Venezuela’s economic fortunes, and the concomitant civil unrest. Political appointments of inexperienced loyalists to management positions of the state-run oil monopoly, Petróleos de Venezuela (PDVSA), under former president, Hugo Chávez, in the late 1990s, coupled with severe limitations on the operations of foreign oil firms, saw production plummet in Venezuela’s lucrative oil fields.

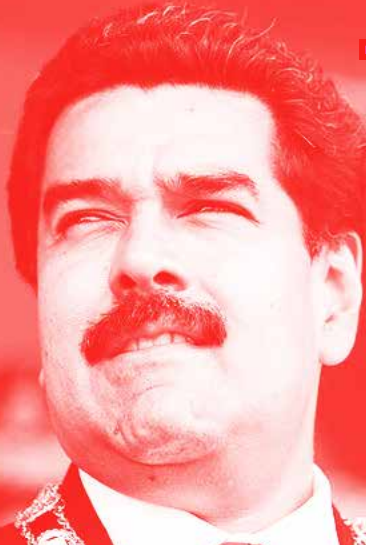

The decline in Venezuela’s oil sector has continued under President Nicolás Maduro. Last month, the Organisation of the Petroleum Exporting Countries (OPEC) reported that Venezuela’s oil production fell to 1.6 million barrels a day, a 20 percent drop from January 2017 and less than half of production levels in the 1990s. The production problems in Venezuela have seen the government start importing gasoline, bitter irony for a country estimated to have some of the richest oil deposits in the world, and which, just three years ago, was processing more than half a million barrels of crude oil a day and exporting a wide range of resultant petroleum products

Venezuelans unable to afford basic staples have taken to the streets to express their dissatisfaction.

It is unsurprising that Venezuelans unable to afford basic staples have taken to the streets to express their dissatisfaction. In 2017, protests took place across the country on an almost daily basis. During the most intensive period of protests between March and August 2017, as many as 165 people were reported to have been killed, and several thousand injured, amid the unrest. Close to 5,000 protesters were arrested.

While the underlying conditions that spurred the protests have not improved, the frequency of protests has decreased significantly, driven, at least in part, by a severe police response. Nevertheless, sporadic incidents of civil unrest persist, driven by frustration with the worsening economic conditions. On 20 September 2018 in Caracas, for example, workers from multiple Venezuelan state enterprises protested low wages and attacks against labour rights. These protests continued in early October in numerous parts of the country, and have taken the form of marches and road blockades. With no clear resolution to Venezuela’s economic plight, the triggers for incidents of civil unrest of this nature remain strongly in place.

The government has acceded to at least some public sector workers’ demands. In response to protests held on 10 October by PDVSA employees over low wages, the government agreed to increase salaries. PDVSA, already struggling with declining production, is desperate to retain engineers and chemists to keep its operations running to avoid the exorbitant costs of an operational shutdown. Unofficial estimates have put the minimum salary offered to PDVSA employees at 1,800 bolivars (about USD 14) a month. Wage increases for PDVSA and other public-sector employees offer only short-term relief, particularly as demands that the private sector keep prices fixed have been largely ignored. Yet, with runaway inflation

ensuring that basic goods remain unaffordable to most Venezuelans, minor concessions from the government are unlikely to appease the public for long. The new salary scale, though a marginal improvement, is unlikely to dissuade skilled employees from seeking more lucrative employment elsewhere, including outside Venezuela. Indeed, an estimated 1.5 million people have fled the country since 2014, with as many as two million expected to depart in 2018. The spillover effects of the crisis have heightened tensions in the region as Venezuela’s neighbours struggle to deal with the influx of people and associated local tensions

With the opposition’s diminished capacity to challenge the government, and the significant economic problems facing Venezuela, the country remains vulnerable to outbreaks of civil unrest.

In August 2018, in an attempt to slow down inflation and limit the impacts of the economic crisis, the government introduced a new devalued currency, anchoring it to a virtual currency supposedly linked to the country’s oil reserves. Other economic measures to stabilise the economy, including a minimum wage hike and an increase in value added tax, were introduced at the same time. Yet, the underlying challenges remain: Venezuela’s mismanaged economy is over-reliant on income from ever declining oil exports.

With the opposition’s diminished capacity to challenge the government through parliamentary processes, given that many opposition leaders have been imprisoned, forced into exile, or barred from holding office, and the significant economic problems facing Venezuela, the country remains vulnerable to outbreaks of civil unrest.