Tourism in crossfire: The impact of the Gaza war on travel to the Middle East

Prior to October 2023, the Middle East was fast becoming synonymous with luxury tourism. Dubai Mall alone touted itself as the ‘most visited place on Earth,’ with 105 million visitors in 2023, while large scale tourism construction initiatives like NEOM and the Red Sea Project made clear Saudi Arabia’s intentions to meet its ambitious growth objectives for the sector. Other countries, like Egypt, have placed particular emphasis on improving its tourism environment, expanding transport accessibility, easing visa regulations, and improving accommodation availability. With significant investment and strategic government policies, it was no wonder that as a whole, the Middle East region outpaced the rest of the world in tourism recovery from the Covid-19 pandemic. In 2023, the Middle East’s tourism sector grew by 20 percent compared to pre-pandemic levels, while other parts of the world only came close to matching the tourist numbers and revenue from 2019.

In October 2023, however, Hamas’s attack on Israel ushered in a period of geopolitical tension not seen in the Middle East for decades. With Israel’s military operations against Hamas and Hezbollah expanding into third-party territories, the war has evolved into a regional proxy conflict, pushing Lebanon, Iran, the Houthis in Yemen and others ever closer to the brink of open warfare. The ramifications of the conflict on the region’s tourism sector are felt hardest in Israel and neighbouring Lebanon and Jordan; but for countries further afield, the shifts in the choices that travellers are making have also left a mark.

Israel

Unsurprisingly, tourism in Israel has come to a halt while the war is ongoing and the threat of attack is high. Most major airlines have suspended flights through Tel Aviv’s Ben Gurion International Airport, standard travel insurance packages no longer offer coverage for Israel, and many foreign governments continue to advise their citizens against travel to the country. In the first six months of 2024, the number of individuals who spent at least one night in a hotel dropped by 81 percent, compared to the same period the year before, and half of those occupants were evacuees, displaced from conflict zones in the north and south of the country. Israel’s Ministry of Tourism has had no choice but to try to mitigate the damage; by April 2024, the government had paid USD 850 million towards the hotel fees for housing thousands of evacuees, and in August, the ministry proposed the allocation of almost USD 20 million towards preserving the wages of essential workers in the sector.

Lebanon

Tourism in Lebanon has proven surprisingly resilient on the surface. For the month of June 2024, the start of Lebanon’s summer season, arrivals through Beirut International Airport reached 406,396, only five percent lower than the year prior. However, looking more closely, the vast majority of these arrivals comprised of Lebanese expatriates, along with some travellers from elsewhere in the Middle East and North Africa – a trend that extended into Lebanon’s busiest tourist months, July and August. Meanwhile, with many governments around the world warning their citizens against travel to Lebanon over safety and security concerns, many foreign tourists are avoiding travel to the country.

With Lebanon’s tourism sector restricted to expatriate business, its restaurant and café sector has proven resilient, but with limited foreign travel, its hotels have suffered. After all, expatriates will typically stay in their own homes, or with friends and family, when visiting the country. As a result, the occupancy of Beirut’s hotels has not exceeded 25 percent since the start of the summer season – normally ranging between 50 and 80 percent – while hotels outside Beirut are averaging about 10 percent occupancy.

Jordan

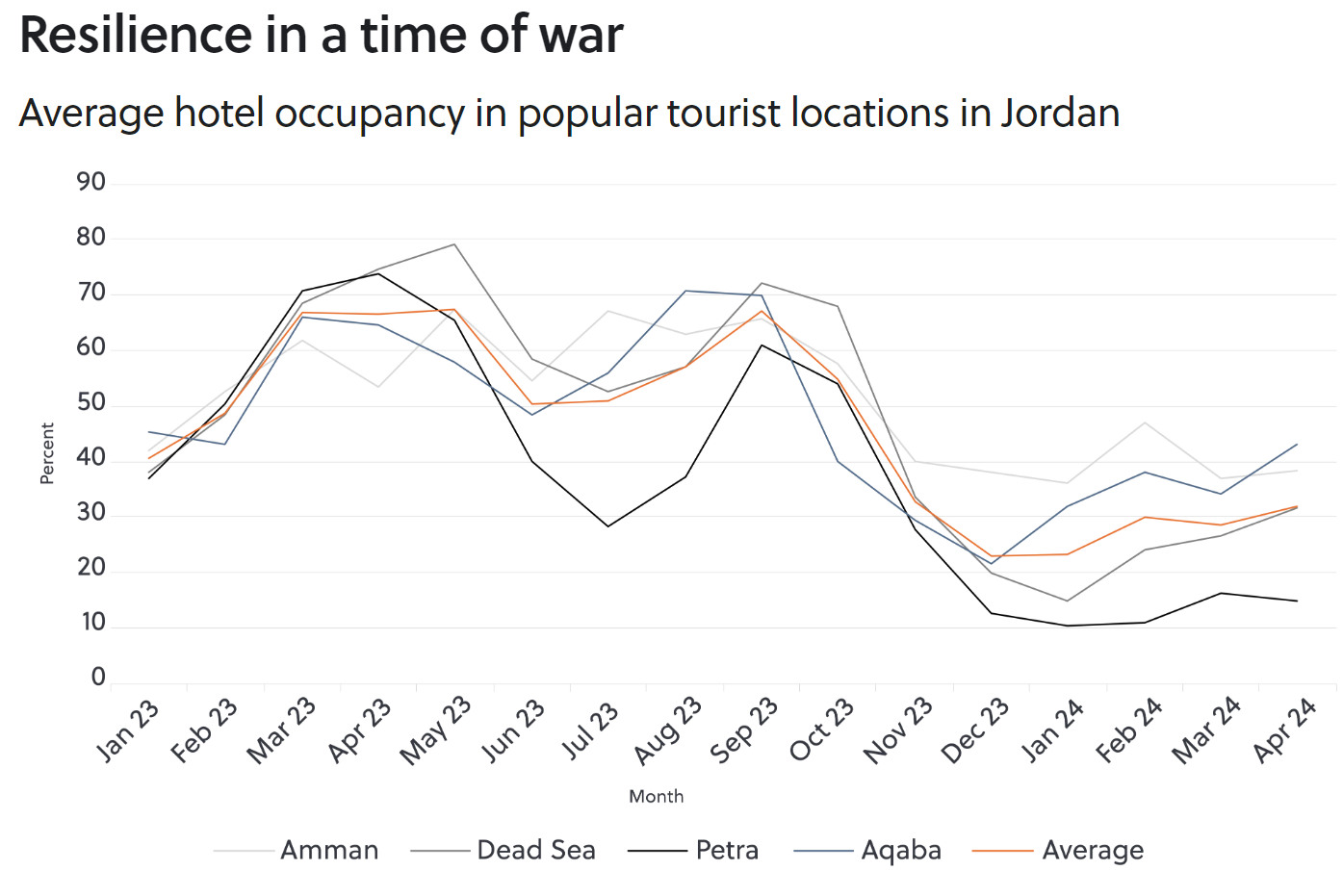

Jordan posted record tourism growth in 2023, with tourist arrivals increasing by 25.8 percent from 2022 to 2023, surpassing the government’s revenue and recovery targets coming out of the pandemic. By the fourth quarter of 2023, however, the war in Gaza was starting to impact the sector, with fears spreading around the world that the conflict may extend to the West Bank, and then involve Jordan. By the first quarter of 2024, tourist arrivals to the country had dropped by 10 percent, compared to the first three months of 2023, with the most significant decreases seen amongst US and European travellers.

The absence of foreign travel is particularly devastating for tourist attractions at which foreign tourists comprise the vast majority of business. At the UNESCO World Heritage Site, Petra, for instance, 70 percent of all visitors are foreign travellers, and as a result, overall hotel occupancy dropped to as low as 10 percent over some months. Some hotels at Petra reported that only three percent of their rooms had been filled since the start of the conflict in Gaza.

While the impact of the war is most stark for these three countries’ tourism sectors, the ripple effects can be felt throughout the region, with some surprising results. Holidaymakers further afield may be choosing to avoid the Middle East as a whole, but travellers within the region still want to go on holiday. Middle Eastern travellers are increasingly likely to choose to visit tourist destinations either in-country or elsewhere in the region, in efforts to save on higher flight prices and other travel costs like insurance. These considerations are particularly prominent in countries like Lebanon, where a financial crisis and depreciating currency has made foreign travel considerably more expensive for locals. Countries like Egypt and Turkey have benefitted from this trend in particular, while the tourism industries in cities like Beirut in Lebanon and Amman in Jordan have been able to retain some measure of resilience. Regarding Gulf countries, Gulf-to-Gulf travel comprised most tourist activity even before the conflict; in Saudi Arabia, for instance, 75 percent of its tourists in 2023 were domestic travellers, while almost 30 percent of in-bound travel comprised of citizens from other Gulf countries, Bahrain, Kuwait, the UAE and Qatar. While several Middle Eastern governments have implemented major strategies aimed at attracting tourists from Europe, the US and elsewhere, regional travel is what will keep these industries afloat through this period of geopolitical upheaval.